Contents:

Although it takes some time to Set up, Class Tracking is worthwhile in the long term. You receive a thorough breakdown of your business expenses and can monitor how your money is being used. Maintaining control of your money is much simpler with this knowledge. Dancing Numbers helps small businesses, entrepreneurs, and CPAs to do smart transferring of data to and from QuickBooks Desktop.

- This new feature makes a great companion, and in some cases a replacement, for Classes, Locations, and Custom Fields.

- Intuit accepts no responsibility for the accuracy, legality, or content on these sites.

- There are two ways to get classes in Housecall Pro as Business Units.

- You only need to set up the withholding tax account and item once.

We’ll also discuss the different types of classes you can create and explain why they’re helpful for your business. Class tracking is a system that enables you to differentiate between different types of classes in QuickBooks Online. In the future, when entering transactions into QuickBooks, use the “Class” drop-down menu to select the desired value and classify the transactions, as needed. Once you have performed this, Next you would be able to add classes designated under the column section.

Using Divisions in QuickBooks

For now, your QuickBooks P&L has one “Total Sales” account with no classes so you can’t see any details about which group sells better or worse. New classes will be created in QuickBooks Online if one does not already exist. Create a new Business Unit or Apply an existing Business Unit to the Job. Imported classes from QuickBooks Online will also appear in the list. You must add the Business Unit exactly as it appears as a Class in QuickBooks Online.

- A profit center is an area or department of your business that you operate for the purpose of generating a profit.

- A manufacturer of running shoes can determine his direct labor and materials costs per shoe, for each shoe model he produces.

- Go back to the Tags home page, and you’ll see that there’s a link to one transaction in the Events row.

- In QuickBooks, you can easily create classes assigned to the transactions.

- Below, we compare and contrast class tracking in Quickbooks to Types, Inventory Tracking, and Locations.

- To import the data, you have to update the Dancing Numbers file and then map the fields and import it.

QuickBooks provides lots of report types based on these lists, designed to meet common information needs. But QuickBooks cannot provide every conceivable report combination or arrangement, and QuickBooks reports don’t offer much in the way of analyzing transaction data. You may often recognize that QuickBooks has the data you need but has no report available to get it out in the format you want or need.

Class Tracking in QuickBooks for Law Firms: Overview

Employees aren’t shared between three or more classes and the sharing percentages are not custom for each employee. You can segment your business to compare results by business units engaged in a similar business. Using classes in QuickBooks is a more effective way to dissect your business to understand it more clearly. I created a new class in Quickbooks and it is not showing in JobNimbus?

This would be a perfect example of where single step vs multi step income statement tracking could come in handy. You could create three separate classes for each location (i.e. Location 1, Location 2, and Location 3). Then you’d need to be sure to assign a class to each transaction so that, down the road, you could accurately compare the financials of each location. In this example, the income and expenses for the business are divided into classes based on location. All locations are represented here and all revenue and expenses are included in one of these classes. For example, you might have “wholesale” and “retail” customer types.

You’ll be provided with a sales receipt template where you’ll be able to select the class from QuickBooks needed for each product group. In our case these classes are “Earrings”, “Rings”, and “Necklaces”. Accounting is extremely important but can be quite challenging for an online business. It’s also crucial for an online business to automate repeated tasks to save time for more important business matters.

• Preferences can be selected from Edit tab from the menu. On QuickBooks, one thing that you must remember is that not every invoice template would be including a column for the classes. As you are done with the creation of class, you can use the class to generate the transactions. First, You have to go to the Edit menu and then from the list of options, Select Preferences Section. And also, if it is a subclass, you need to opt for the subclass of checkbox and then look for the class it is under in. After that, choose the transactions in the workflow section.

To Turn on Class Tracking in QuickBooks Online:

Accounts mostly organize transactions into financial categories–income, expenses, payables, receivables, etc.–but classes let you organize transactions into any categories you want. The Classes list is empty when you first create a QuickBooks company file, so you can set up any classes you want in it. Most often you’ll used classes for grouping transactions into management information categories as opposed to the financial accounting categories provided by the Chart of Accounts.

how to set up car loan in quickbooks online -【online loan entrance … – Caravan News

how to set up car loan in quickbooks online -【online loan entrance ….

Posted: Mon, 24 Apr 2023 22:19:21 GMT [source]

To set your own conditions for categorization, create a free Synder account , or contact our specialists to pick the time for a proper demo session. Imported jobs from QuickBooks Online will include any class that is applied to a job. A trucking/transportation company can get reports of various truck operating costs per mile driven, or per driver hour, or per dollar of freight revenue, etc. And here are a couple of Profit and Loss with Classes Report examples, showing cost-per-unit detail for individual classes. The first relates to our discussion of trucking costs.

The “Golden Rule” of Account and Class Setup

One employee terminated a year ago but still shows up with all zeros . How do I eliminate employee from the heading – I deleted employee from the class list . I would like to use the Class List as a way to track ‘budgets’ for each department….the first entry would be “Budget 2013” and the rest expenses. I know how the expenses come out – I’ve got the spending part down.

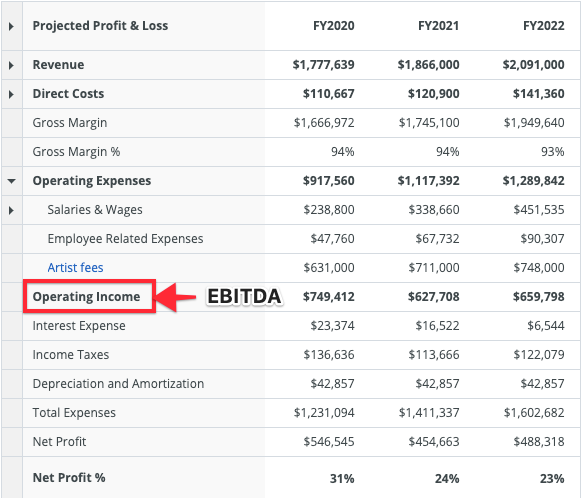

In fact, most financial reports are just summaries of account balances or account activity. For example, a Profit and Loss Report like the simple one at right simply displays income and expense account totals for a specific period of time; one month in this case. You can achieve this by using a filter, sort, or total report by class. Class & location tracking provides a way to separate your lines of business without having to create unique QBO accounts. Class & location tracking allows you to view profitability for each line of business separately, eliminating manual manipulation of the reports to pull the information out. We are a distribution company with various locations around the country.

Classes are customizable to group records by whatever label you need, such as Departments, Properties, Construction, Concrete, Commercial, Residential etc. Synder software brings all your sales and expenses along with all the details needed into QuickBooks automatically. You just need to have QuickBooks and all your sales channels and payment platforms connected to the app. Use the button below to leave a message and we’ll respond with guidance as soon as we’re back in the office. In the meantime, select either choice above to view the site. We will, however, keep your credit so that you may attend another class in the future.

You can even use classes for “ad hoc” kinds of things. Suppose a storm has damaged some buildings and you need to keep track of all the repair bills, so that later when repairs are completed you can submit a total bill to your insurance agent. Also check the “Prompt to assign classes” checkbox to remind whomever performs data entry in QuickBooks to classify all transactions entered.

QuickBooks Training class LaFayette

Therefore, you’re best served by editing your current classes to match your needs as closely as possible and to use sub-classes to refine what you have if necessary. Select the Use class tracking checkbox, then close the Transactions window to save the changes. Select the Use class tracking for transactions checkbox. Tagging is one of the innovations in QuickBooks® Online that allow you to label and organize your data with flexibility. Tags have long been available in email programs, photo libraries, and other applications, and now tagging is available in your accounting software! This new feature makes a great companion, and in some cases a replacement, for Classes, Locations, and Custom Fields.

Most often you’ll use classes for grouping transactions into management information categories as opposed to the financial accounting categories provided by the Chart of Accounts. This lets you track account balances by department, business office or location, separate properties you own, or any other meaningful breakdown of your business. For example, if you had a restaurant with three locations, you might create an Uptown, a Midtown, and a Downtown class for tracking income and expenses by location.

A manufacturer of running shoes might set up different classes for each step in the manufacturing process, to better understand labor and materials costs for each step. Or he might set up a class for each model of shoe produced, to know what each shoe model costs to produce. If your business works with multiple customers and vendors and has many invoices and expenses to record, you shou… Segment expenses with classes in QuickBooks online to get a better understanding of your financials. Once you’ve done that, the class will be updated in QuickBooks. However, remember that any transactions related to the class will also be affected by the changes you have made.

This feature can be of great help to the businesses with different departments, as it would help them to use classes to report account balanced for each department. Class tracking might seem to be a tedious process, by it pays off in the long run. The users get an amazing overview of the company expenses and can also see the way their money is being spent, which ultimately makes it easy for you to stay on top of the budget. Note that the net effect of each Journal entry will be to leave the Overhead Allocationaccount’s balance at zero, because it is debited and credited by the same amount. A profit center is an area or department of your business that you operate for the purpose of generating a profit. A main goal of cost accounting is to evaluate whether each of those areas is profitable.

LEARN QUICKBOOKS/EXCEL IN ONLY ONE MONTH !! – COLlive

LEARN QUICKBOOKS/EXCEL IN ONLY ONE MONTH !!.

Posted: Sun, 23 Apr 2023 01:47:34 GMT [source]

Available in Plus and Advanced, classes allow you to track income and expenses across various segments or revenue streams of your business. Class tracking is especially useful for businesses that offer different product or service lines or those with individual divisions, such as products & services, wholesale, or retail. A retailer that sells shoes and clothing can track the sales and purchases related to each product line separately.